TradeSmart University, it's teachers and affiliates, are in no way responsible for individual loss due to poor trading decisions, poorly executed trades, or any other actions which may lead to loss of funds.Each merchant needs to exchange Candlestick pattern PDF with benefit. Students and individuals are solely responsible for any live trades placed in their own personal accounts. TradeSmart University encourages all students to learn to trade in a virtual, simulated trading environment first, where no risk may be incurred. Options trading involves risk and is not suitable for all investors. Individuals must consider all relevant risk factors including their own personal financial situation before trading. The risk of loss trading securities, futures, forex, and options can be substantial.

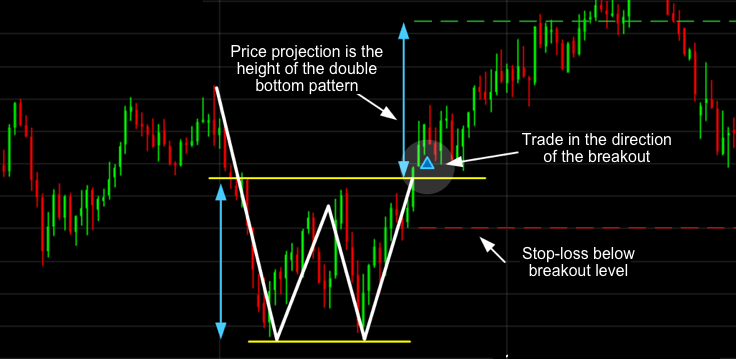

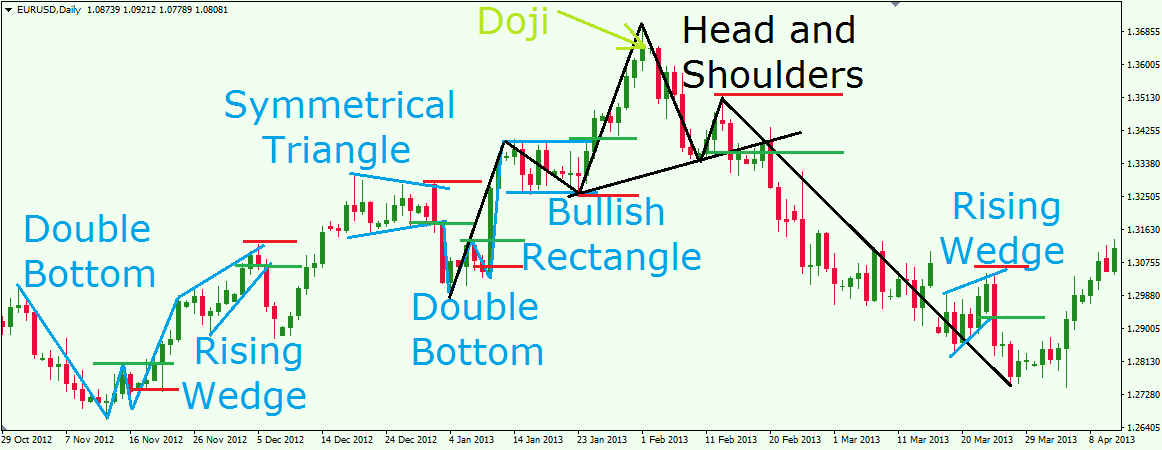

RISK DISCLAIMER: The information presented on this website and through TradeSmart University is for educational purposes only and is not intended to be a recommendation for any specific investment. When you pair them up with basic technical analysis and other pattern studies like Candlestick patterns, Chart patterns are a priceless analysis technique you will certainly want to master. Not only do they give you a pattern to trade for profits, they give you powerful insights that no other trading technique will provide. I’m certain as you learn more, you will quickly discover chart patterns are a valuable tool to add to your skills as a trader. When you learn to interpret chart patterns, you are learning to read human behavior as it appears in the stock price. If they are optimistic, they will buy it.Ĭhart patterns reflect that human sentiment that we see in the trades. What matters is how the people trading that stock "feel" about it. It doesn’t matter what the “statistics” suggest a stock should be worth. People are the main driving force behind buying and selling behavior. This is one of the core tenants of Technical analysis. Never have we had such a great opportunity to work with such powerful tools and combine it with the rich history of quality technical analysis.Ĭhart patterns are just one of the components that make this study so valuable.Ĭhart patterns work because people are predictable. As traders, we owe it to ourselves to take the time to learn these tools and techniques.īecause at the end of the day, the goal of every trader is to make money. No other time in history has presented so many amazing tools for the study of chart patterns and technical analysis. Not only will they draw charts, but we can switch to see a different time frame in seconds.

#Stock chart patterns software#

One of the benefits of living in the 21st century is the reality that today, we have powerful charting software that can draw charts instantaneously. As far back as the 1700’s the great Japanese trader Sokyu Honma had already developed trading systems built around chart patterns. The history of chart patterns goes back hundreds of years. Also, by recognizing chart patterns, you can better take advantage of many good situations. When you approach chart patterns the way they were originally used, I expect you will find they work much better, much more consistently, and as a result, you will have the opportunity to make much bigger profits when trading patterns!Ĭhart patterns can be a very advantageous study to understand because when you do understand them, your ability to recognize and avoid dangerous situations goes up exponentially. Along the way, I will add some of my commentary and distinctions from personal use, but for the most part, I intend to stay true to the original usage of the patterns. I’m going to share the art form in the way that I learned it.

#Stock chart patterns series#

In this post and series of articles, I’m going to share the more traditional view of chart patterns. If you read one blog it will tell you that such and such is a head and shoulders pattern, then if you read another blog, it will tell you why the first blog you read was completely wrong. Perhaps one of the most difficult aspects of learning chart patterns is the reality that there are so many “versions” of what is supposedly truth on the matter. Regardless of your cultural background, one thing we know for sure about chart patterns: They work.Īs with all technical tools that “work,” inevitably various groups of followers will jump on board using the tools and before long, the original skills and techniques have become distorted and lost in the retelling. If you go to the other side of the world, however, in Japanese trading we have history going as far back as the 1700’s that shows a very active and well-codified use of chart patterns. In western trading, we know chart patterns go back at least to the 1920’s and 30’s. Chart patterns are one of the few anticipation methods that has stood the test of time.

0 kommentar(er)

0 kommentar(er)